May 22, 2020

UPDATE: Since the Civic Federation published this blog post, there have been two significant updates to report, as detailed in this follow-up post.

Governments frequently borrow funds on a short-term basis to deal with cash flow problems, and this year, due to the massive economic disruption caused by the COVID-19 pandemic, the State of Illinois and many local governments will face large cash shortfalls as revenue collections are delayed or they fall far below original projections. The State of Illinois has confirmed that it will submit a notice of interest to participate in a special Federal Reserve Bank short-term borrowing facility to help close its FY2020 budget deficit and is proposing to use it for the FY2021 projected budget deficit as well.[1] This blog will provide an overview of the use of short-term debt in Illinois and the Federal Reserve Bank’s new Municipal Liquidity Facility (MLF).

Please note that as of publication of this post, the State of Illinois’ plans cited here are in flux and may include revisions to some of the statutes cited below. The Civic Federation will update this blog as necessary to accommodate any changes.

Potential Revenue Shortfalls in Illinois This Year

The State of Illinois expects revenues for FY2020 to be $2.7 billion less than originally projected in February 2020 and FY2021 base revenues to be roughly $4.6 billion less than the estimate at that same time.[2] The State announced in April that it planned to borrow as much as $1.2 billion in short-term notes to deal with the FY2020 shortfall.[3] However the State has delayed the bond sale. Illinois’s perilous financial situation will require it to pay steep penalties to sell the debt, as demonstrated by the large spreads on $800 million in long-term debt the State issued last week. The one-year bonds included in the sale had an interest rate of 4.875%.[4] The State had previously said that the $1.2 billion deal could move forward when market conditions are more favorable, but it has also recently confirmed that it is submitting a notice of interest to use the Federal Reserve Bank’s Municipal Liquidity Facility, which would mean that the MLF would participate in the State’s statutorily-required competitive bidding process for short-term debt issuances.[5] As noted above, the State is now also proposing to use the MLF for up to $4.5 billion in short-term borrowing to help close its FY2021 budget gap.[6]

At the local government level, some counties have already acted to remove penalties for late property tax payments, in effect extending the payment deadline, thus significantly delaying the receipt of revenues. The Cook County Board approved a plan to waive the 1.5% interest rate per month on late property tax payments that usually would be due on August 3rd until October 1st. In addition, there also could be delays in the receipt of state revenue sharing funds and/or declines in the amount of revenue provided. This could force local governments, including municipalities and school districts, to borrow funds in anticipation of receiving revenues at a later date. While short-term borrowing rates are lower than those for long-term debt, they can still be a significant cost for cash strapped local governments.

Purpose of Short-Term Debt

Short-term debt is debt that typically matures in a period of one year or less, though debt that matures in periods up to three years is also sometimes considered short-term. This type of debt usually carries a lower interest rate than long-term debt due to its shorter maturities. If the short-term debt issued is tax exempt, federal regulations mandate an analysis of the government’s cash flow needs by preparing monthly cash flow estimates. These short-term notes or warrants must mature within either a period of 13 months after they were issued or 60 days after the due date of the taxes or fees being anticipated.[7]

Short-term debt can be issued to fund certain pay as you go capital projects. However, a more common reason for issuing short term debt is to deal with cash flow issues. Cash flow problems often develop because of a temporary mismatch between when revenues are received by a government and the timing of required expenditures. For example, in Cook County the first installment of property taxes is due on the first business day in March and the second installment tax bills are due on August 1st.[8] But governments heavily dependent on property tax revenues must pay salaries and other expenses on a regular basis, which can lead to cash shortfalls. The problem can be exacerbated if there are delays in sending out the property tax bills on time, pushing out the date when revenues are actually received.[9]

In these situations, governments could use reserves. Many, however, do not maintain sufficient reserves or do not desire to tap into reserves. Instead, they issue short-term notes or warrants in anticipation of receiving revenues to deal with the temporary cash flow problem.

Types of Short-Term Debt

There are variety of short-term debt instruments.[10] They are described in brief below.

Tax Anticipation Notes (TANs) or Tax Anticipation Warrants (TAWs) are issued in anticipation of the collection of taxes, especially property taxes. TANs are secured with the tax collection proceeds.[11]

In Illinois, TANs are general obligation debt with a fixed maturity date. TANs cannot exceed 85% of the total amount of tax levied for the fund receiving these proceeds. The total amount of these notes issued cannot exceed 85% of the government’s equalized assessed valuation (EAV) multiplied by the maximum tax rate for the fund in question.[12] Another form of TAN, personal property replacement tax anticipation notes, also may be issued.[13] These notes must be issued in an amount that does not exceed 75% of the amount the government is entitled to receive in the year the bonds are issued.[14]

The Illinois Debt Reform Act allows local government to issue general obligation tax warrants.[15]

For home rule jurisdictions not subject to the Property Tax Limitation Extension Law (PTELL), the security pledge is ad valorem taxes levied on taxable property without rate or amount limitations. When the warrants are issued, the county clerk must reduce the tax rate for the specified tax by a percentage necessary to generate sufficient funds to pay the debt service on the warrants.

Non-home rule governments subject to PTELL may issue either refunding warrants or general obligation bonds to refund warrants if taxes are delayed or insufficient to pay those warrants. These warrants or bonds are secured by a pledge of ad valorem taxes on taxable property without rate or amount limit for governments. They must be in the form of limited bonds.

Tax warrants issued are not considered in computations of statutory debt limits. General obligation bonds issued to refund warrants may be issued without consideration of debt limitations on existing debt, but after they have been issued, must be considered as indebtedness.

Revenue Anticipation Notes (RANs) are issued in anticipation of collection of a variety of non-tax revenues, including user fees and charges. They are repaid with revenue collection proceeds from the financed project. Projects commonly financed with RANs include stadium renovations and recreation centers.[16]

Revenue Anticipation Notes in Illinois may be issued in anticipation of the local government receiving revenues from a variety of sources, including federal aid, state revenue sharing from sales, income or other taxes and/or local taxes and fees. These notes cannot be issued in excess of 85% of the revenues they draw upon. They must be paid directly from those revenues and do not factor into calculations of the government’s statutory debt limits.[17]

Grant Anticipation Notes (GANs) are issued in anticipation of the government receiving federal or state grants. They are secured with the grant proceeds. In Illinois, library systems may issue GANs in anticipation of receiving State library grant funds. These notes cannot be issued in excess of 75% of the revenues they draw upon and must be paid directly from those revenues.[18]

Bond Anticipation Notes (BANS) are issued in anticipation of receiving the proceeds of long-term bonds. They are secured with the proceeds of the bond issue.

Tax Exempt Commercial Paper is a type of short-term (30-270 days) uncollateralized borrowing. It is often backed by an irrevocable letter of credit, a revolving credit agreement or a line of credit issued by a commercial bank.[19]

Interfund Borrowing by Illinois municipalities is permitted. This allows them to borrow money from one fund for use by another fund. The borrowing must be repaid within one year and can only be authorized for a lawful purpose.[20]

Promissory Notes are a written pledge to pay a sum of money on a defined date. A promissory note contains features similar to that of other forms of indebtedness, including as the principal amount, interest rate, maturity date, date and place of issuance and the issuer's authorization.[21] Illinois state law requires the promissory note must be authorized by an ordinance and executed by the chief executive officer of the municipality. The promissory note must be repaid within ten years.[22]

State of Illinois Issuance of Short-Term Debt

The Illinois Constitution and state statutes contains several provisions regarding the issuance of short-term debt for state purposes. These references are summarized below.

Cash Flow Borrowing

The State may borrow funds in anticipation of receiving revenues at a future date for cash flow purposes in an amount that does not exceed 5% of the State's appropriations for that fiscal year. The borrowed funds must be repaid by the close of the fiscal year in which borrowed.[23]

Borrowing for Emergencies

The Governor, Comptroller and Treasurer may borrow funds in an amount that does not exceed 15% of the State's appropriations for that fiscal year to meet deficits caused by emergencies or failures of revenue. The debt must be repaid within one year of the date when it is incurred.[24]

Before incurring the short-term debt, the Governor must give written notice to the Clerk of the House of Representatives, the Secretary of the Senate, and the Secretary of State setting forth the reasons for the proposed borrowing and the corrective measures recommended to restore the State's fiscal soundness. No debt may be incurred until 30 days after the notice is served.[25]

The State of Illinois had planned to issue as much as $1.2 billion in short term notes in May 2020 to provide liquidity in the remaining months of FY2020.[26] The notes would be payable by May 15, 2021. As noted above, under the Short Term Borrowing Act, this is permitted for the failure of revenues.[27] Fitch had assigned a credit rating of BBB- with a negative outlook to these notes. The State had applied to Moody’s Investors Services for a rating on the notes, but had not received one as of the date of the aborted issuance.[28] As of this writing, the State has had to delay the bond sale because Illinois’s perilous financial situation will require it to pay steep penalties to sell the debt. The deal will move forward when market conditions are more favorable[29] or it may move forward under the Federal Reserve Bank’s MLF, described below.

Federal Reserve Bank’s Municipal Liquidity Facility

On April 9, 2020 the Federal Reserve Bank announced the creation of the Municipal Liquidity Facility. The Facility’s mission, as subsequently amended, is to support lending to the following jurisdictions: states; the District of Columbia; cities with populations over 250,000; counties with populations over 500,000; and multi-state entities. State-level issuers may use proceeds they obtain to support additional counties and cities.[30] Access to these loans is intended to assist state and large local governments to deal with temporary cash flow problems generated by the negative impact of the COVID-19 pandemic on government revenues.

The Federal Reserve Bank of New York will lend funds to a special purpose vehicle (SPV) until December 31, 2020.[31] The SPV is authorized to purchase up to $500 billion of tax anticipation notes, tax and revenue anticipation notes, bond anticipation notes and other short-term notes as long as these notes mature no later than 36 months from the date they were issued. The borrowings will be secured by the assets of the SPV.[32] The $500 billion figure represents approximately 20% of state and local governments’ own source general and utility revenues of $2.4 trillion in 2017 and over ten times as much as the $40 billion that these governments borrowed in short-term instruments in 2019.[33]

Issuers that are not multi-state entities that will have access to the Municipal Credit Facility must possess a credit rating of at least BBB-/Baa3 as of April 8, 2020 from two or more major, nationally recognized rating organizations. Eligible issuers that were rated at least BBB- /Baa3 as of April 8, 2020, but were subsequently downgraded, must be rated at least BB-/Ba3 by two or more major rating organizations at the time the Facility makes a purchase.[34] Only one issuer per State, City, county or Multi-State entity is eligible. However, the Federal Reserve can approve additional issuers to facilitate assistance to political subdivisions.[35]

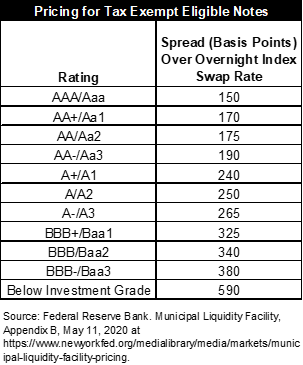

On May 11, 2020, the Federal Reserve released a pricing guideline for tax exempt eligible notes under the facility. The pricing will be at a fixed interest rate based on a comparable maturity overnight index swap (“OIS”) rate plus the applicable spread based on the long-term rating of the issuer. As State of Illinois debt is rated at Baa3 with a negative outlook by Moody’s Investors Services, BBB- with a negative outlook by Standard & Poor’s and BBB- with a negative outlook by Fitch,[36] the spread over the OIS rate for pricing short term bonds issued would be 380 basis points. As noted above, when the State of Illinois issued $800 million in long-term notes last week, the one-year interest rate was 4.875%.

The limit that Illinois could borrow from the Municipal Liquidity Facility is $9.7 billion. This was based on an estimated total of $48.4 billion in own source general and utility revenues. The City of Chicago could borrow up to $1.4 billion, based on own source general and utility revenues of $2.7 billion.[37]

Illinois’ constitutional and statutory short-term debt limitations may limit the amount of funding that the State can access from the Municipal Liquidity Facility. The state may only borrow funds in an amount that is up to 15% of fiscal year appropriations to deal with emergencies or failures of revenues. It may only borrow for cash flow purposes in an amount up to 5% of fiscal appropriations.[38]

Illinois law requires competitive bids for short term borrowing. Thus in order for the SVP to participate in a short-term note sale, it would have to be the successful bidder in a competitive offering.[39] The Federal Reserve has clarified that it will submit bids in a competitive sale process in situations where the issuer is required by statute to sell notes through such a process.[40]

[1] Illinois State Representative Greg Harris, Discussion of SB264 in House Executive Committee, May 22, 2020.

[2] State of Illinois Preliminary Official Statement Dated April 29, 2020, p. 7.

[3] Greg Hinz. “Pritzker is about to try the bond market to shore up the state’s liquidity.” Crain’s Chicago Business, April 28, 2020.

[4] State of Illinois Official Statement, General Obligation Bonds, Series of May 2020.

[5] Shruti Date Singh and Danielle Moran. “Illinois Delays $1.2 Billion Debt Sale After Yield Penalty Soars,” Bloomberg, May 5, 2020 at https://finance.yahoo.com/news/illinois-delays-1-2-billion-165252921.html and Yvette Shields, “Illinois may borrow using MLF after a Fed policy adjustment,” Bond Buyer, May 19, 2020 and Communication with the Governor’s Office of Management and Budget, May 20, 2020.

[6] Illinois State Representative Greg Harris, Discussion of SB264 in House Executive Committee, May 22, 2020.

[7] Chapman and Cutler. Tax And Revenue Anticipation Notes and Warrants at https://www.chapman.com/practices-Tax-Revenue-Anticipation-Notes-Warrants.html.

[8] Cook County Treasurer at https://www.iml.org/cms/files/pages/Financing-Options-Using-Bonds.pdf.

[9] This occurred frequently in Cook County until 2012. Cook County Government. Second-Installment Property Tax Bills to be Mailed on Time for Second Consecutive Year at

[10] This discussion is primarily drawn from Investopedia, Anticipation Note at https://www.investopedia.com/terms/a/anticipation-note.asp.

[11] Chapman and Cutler. Tax And Revenue Anticipation Notes and Warrants at https://www.chapman.com/practices-Tax-Revenue-Anticipation-Notes-Warrants.html.

[12] Local Government Tax Anticipation Note Act (50 ILCS 420/).

[13] Personal property replacement taxes (PPRT) are imposed at a rate of 2.5% on net corporate income, 1.5% on net income from Partnerships, trusts, and S corporations and a 0.8% rate in invested capital Personal property replacement taxes were authorized by the 1970 Illinois Constitution to replace local government replacement taxes which had been abolished. Illinois Department of Revenue. What are Personal Property replacement Taxes at https://www2.illinois.gov/rev/localgovernments/Pages/replacement.aspx.

[14] Chapman and Cutler. Tax And Revenue Anticipation Notes and Warrants at https://www.chapman.com/practices-Tax-Revenue-Anticipation-Notes-Warrants.html.

[15] The sources for the discussion of general obligation tax warrants are the Local Government Debt Reform Act. (30 ILCS 350/14) and Chapman and Cutler. Tax And Revenue Anticipation Notes and Warrants at https://www.chapman.com/practices-Tax-Revenue-Anticipation-Notes-Warrants.html.

[16] Investopedia, Revenue Anticipation Note at https://www.investopedia.com/terms/r/ran.asp

[17] Local Government Revenue Anticipation Act (50 ILCS 425/).

[18] Illinois Library System Act (75 ILCS 10/8.2) (from Ch. 81, par. 118.2).

[19]Investopedia. Tax-Exempt Commercial Paper at https://www.investopedia.com/terms/t/taxexemptcommercialpaper.asp.

[20] Illinois Municipal Code (65 ILCS 5/8-1-3.1).

[21] Investopedia. Promissory Note at https://www.investopedia.com/terms/p/promissorynote.asp.

[22] Illinois Municipal Code (65 ILCS 5/8-1-3.1).

[23] Illinois State Constitution Article IX, Section 9(c) State Debt and the Short Term Borrowing Act (also 30 ILCS 340/1 from Ch. 120, par. 406).

[24] Illinois State Constitution Article IX, Section 9(d) State Debt and Borrowing for Failure of Revenues (also 30 ILCS 340/1.1).

[25] Short Term Borrowing Act (also 30 ILCS 340/1 from Ch. 120, par. 406).

[26] Greg Hinz. Pritzker is about to try the bond market to shore up the state’s liquidity. Crain’s Chicago Business, April 28, 2020.

[27] State of Illinois Preliminary Official Statement Dated April 29, 2020, p. ii.

[28] State of Illinois Preliminary Official Statement Dated April 29, 2020, p. iii.

[29] Shruti Date Singh and Danielle Moran. Illinois Delays $1.2 Billion Debt Sale After Yield Penalty Soars, Bloomberg, May 5, 2020 at https://finance.yahoo.com/news/illinois-delays-1-2-billion-165252921.html.

[30] Board of Governors of the Federal Reserve System. Municipal Liquidity Facility at https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200427a1.pdf.

[31] A special purpose vehicle is a legal entity created specifically to facilitate a financial arrangement or instrument. See Business Dictionary. Special Purpose Vehicle at http://www.businessdictionary.com/definition/special-purpose-vehicle-SPV.html.

[32] Board of Governors of the Federal Reserve System. Municipal Liquidity Facility at https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200427a1.pdf.

[33] Moody’s Investors Services. Fed liquidity facility will help state and local governments cope with coronavirus crisis. April 15, 2020 at https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBM_1223924.

[34] Board of Governors of the Federal Reserve System. Municipal Liquidity Facility at https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200427a1.pdf.

[35] Board of Governors of the Federal Reserve System. Municipal Liquidity Facility, May 11, 2020 at https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200511a1.pdf.

[36] State of Illinois Official Statement, “$800 Million State pf Illinois General Obligation Bonds, Series of May 2020, May 15, 2020, p. 59.

[37] Board of Governors of the Federal Reserve System. Municipal Liquidity Facility, Appendix A, May 11, 2020 at https://www.newyorkfed.org/medialibrary/media/markets/municipal-liquidity-facility-eligible-issuers.

[38] Illinois State Constitution Article IX, Section 9(c) State Debt and the Short Term Borrowing Act (also 30 ILCS 340/1 from Ch. 120, par. 406).

[39] Information provides by Governor’s Office of Management and Budget May 13, 2020.

[40] Board of Governors of the Federal Reserve System. FAQs: Municipal Liquidity Facility, May 15, 2020 at https://www.newyorkfed.org/markets/municipal-liquidity-facility/municipal-liquidity-facility-faq.